It also helps business owners determine whether they can generate high profit by increasing prices, decreasing costs, or both. Learn to analyze an income statement in CFI’s Financial Analysis Fundamentals Course. Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income. Though each is different https://www.bookstime.com/ from the others, it serves an important purpose in the grand scheme of things, which is to help you achieve your financial goals. An unexpected benefit of a Roth IRA, and one of the reasons I’m such a strong proponent, is that it’s an excellent account to learn how to invest. For example, you’ll need to meet with the trustee that will hold your account.

- Service Revenues is an operating revenue account and will appear at the beginning of the company’s income statement.

- It is a way for an organization to understand how much they are spending to make the money they are making.

- Update and review your financial statements from time to time so you can see your progress toward your business goals.

- However, it uses multiple equations to determine the net profit of the company.

- An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter.

Include Operating Expenses

- If you’re serious about building wealth, there are seven types of accounts you need to have to make it happen.

- Net income—or loss—is what is left over after all revenues and expenses have been accounted for.

- The wealthy make sure their money is working for them, even in their checking accounts.

- Unlike an employee, you don’t have withholding taxes taken out of each paycheck.

- After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

And once you have them up and running, you’re going to see your wealth begin to grow faster than you ever imagined. If you’re serious about building wealth, there are seven types of accounts you need to have to make it happen. Don’t worry if you don’t have them right now – that’s the whole point of this article. I didn’t have them either when I began my wealth-building journey, but I added them as I moved forward. We can interpret the new name of this statement simply as it is provided.

Generate a Trial Balance Report

Cash inflows are recorded on an accounting basis following the receipt of cash. This may cause some people to think that they are inefficient, since money has been sitting around for days or months before being recorded. On the other hand, income statements do not illustrate this; they usually show income before taxes. Thus, the Cash Flow statement is particularly useful in determining taxable income. The income statement describes the income achieved by the reporting entity during a specific accounting period.

- The three major financial statement reports are the balance sheet, income statement, and statement of cash flows.

- It cost the business approximately $2.7 billion to achieve those sales.

- Income statements are designed to be read top to bottom, so let’s go through each line, starting from the top.

- One of the most important sources of reliable and audited financial data is the annual report, which contains the firm’s financial statements.

Income Statement Items Explained (With Examples)

It allows them to see how much profit they are making and, in any way, they can better improve their efficiency. A survey reported that only 53 out of 600 of the surveyed companies disclosed this type of item. The second item involves determining the income or loss earned through operating the discontinued segment from the beginning of the fiscal year up to the date that the decision to discontinue is finalized. With this background, we can now turn to a more detailed description of the structure of the income statement.

That’s how you’ll learn about your investment options and the specifics of how the account works. And unlike the other account types on this list, it’s not for investing in financial instruments either. If you want to be really income statement accounts accurate, have an accountant or tax preparer analyze your income for the year and let you know how much you should be allocating for tax payments. When you’re self-employed, you have to make tax deposits throughout the year.

- First, input historical data for any available time periods into the income statement template in Excel.

- An income statement is generally and officially called the Statement of Comprehensive Income.

- The operating revenue for an auto manufacturer would be realized through the production and sale of autos.

- Income statements are important because they show the overall profitability of a company and help investors evaluate a company’s financial performance.

- These ratios examine the organization’s financial health and can be used to benchmark performance.

The matching concept requires an offsetting of these efforts (expenses) against the rewards (revenues). Expenses represent the gross decreases in owners’ equity caused by operating events. Revenues constitute the gross increases in owners’ equity caused by operating events. The two sub-elements within the operating category are revenues and expenses. Often shortened to “COGS,” this is how much it cost to produce all of the goods or services you sold to your customers.

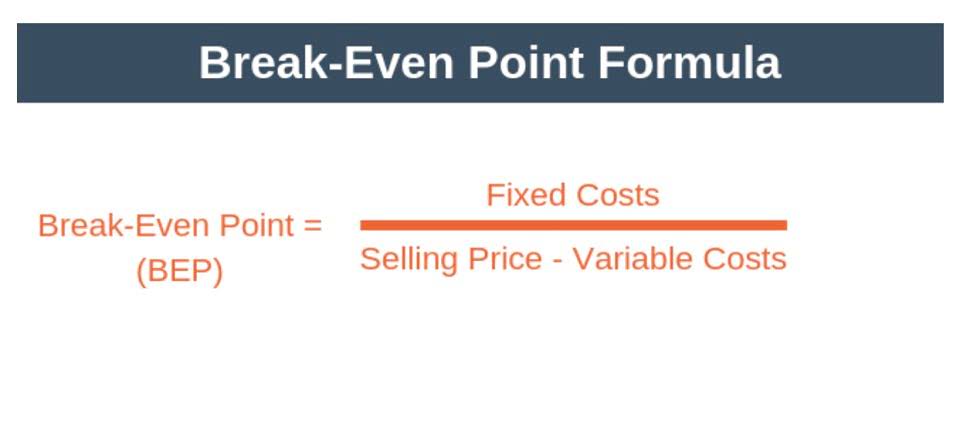

In other words, the entity does not manage its production costs effectively. To calculate total income, subtract operating expenses from gross profit. This number is essentially the pre-tax income your business generated during the reporting period.